Streamlining Time Series Analysis with Imply Polaris

We are excited to share the latest enhancements in Imply Polaris, introducing time series analysis to revolutionize your analytics capabilities across vast amounts of data in real time.

Learn MoreFor years, fraud was primarily a game of strategy. Fraudsters sought to disguise their true intentions, and fraud prevention was an art of detection. Today, fraud is still a game of wits but it has also evolved into a game of speed and volume. The advancement of technology and explosion of e-commerce has had a compounding effect. No longer are fraudsters shackled by the need to physically steal a credit card and visit a store or meticulously forge a check they bring to a bank. In the digital realm they can easily disguise themselves, move faster and exist in several places at once.

Conversely, for fraud prevention teams, these advancements and the nature of online transactions means the window for detecting and stopping fraud has shrunk to sub-seconds. It isn’t enough to see through the disguise, you have to see through it in time.

For fraud prevention teams, the window for detecting and stopping

fraud has shrunk to sub-seconds.

Ibotta, a free cash back rewards platform, is no exception to this phenomenon. As the success of the business and surface area of our system grow, the introduction of new and compelling features in the app also create space for bad actors to find holes in our armor. But as fraudsters have become more sophisticated, so have we. Our commitment to the integrity of our system has led to the creation of a best-in-class fraud prevention analytics program known internally as Cyberfraud Intelligence & Analytics (C.I.A. – because obviously).

To address the element of time, Ibotta’s fraud prevention strategy is multifaceted. The fact is, you can only combat automation with automation, and so we rely on a combination of 3rd party vendors and home-grown systems to make decisions about fraud in real-time. Those systems work around the clock to keep both our end users, whom we call our Savers, and our Brand and Retail partners safe. But fraud is constantly evolving. It is a moving target and inevitably fraudsters find a way to slip through. When that happens we turn to our on-call analysts and investigators and this is where our new partnership with Imply has significantly enhanced our capabilities.

Using the unique and highly specialized tools that the Imply team has built into their product, we have already delivered remarkable results that are bolstering our resilience against fraud; moreover, we have successfully introduced and clearly proven the value of real-time analytics as a paradigm to the larger organization.

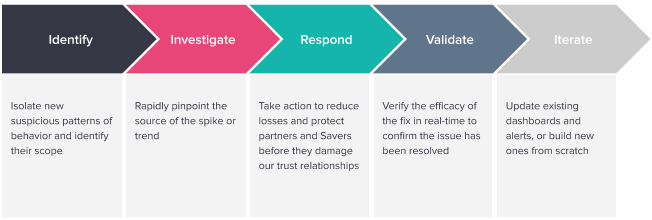

For those who have experienced a fraud on-call shift, you know initial detection is key, but equally important is the ability to quickly dissect and address the problem to minimize losses. This means access to real-time data is paramount.

Architecturally, Ibotta has walked a path familiar to many modern applications: we started with a monolith, and over time grew into a network of carefully orchestrated, message-driven microservices, facilitating greater resiliency, responsiveness, elasticity, and maintainability (these characteristics, with their powers combined, make up the Reactive Architecture paradigm). As a result, we have achieved a robust and growing ecosystem powered by event data.

That event-driven architecture gives our applications the ability to respond to changes in the environment in real-time, and it powers our fraud prevention services. Prior to our implementation of Imply, our analysts did not yet have the ability to unlock that data until hours later due to the mechanics of the pipeline into our data lake. And without a platform specialized for ingesting and exposing real-time data to analysts, our on-call team faced several high-impact roadblocks:

Dispersed Data

Each of our 3rd party vendors includes their own real-time portal to review transactions and other flagged events. In isolation, the data provided by each vendor tells a powerful but incomplete story and analysts lose valuable time with each portal they had to visit.

Obsolete Dashboards

Visualization is a powerful ally to an analyst looking to quickly understand the latest fraud trends. But fraud never stands still. The tools we had for visualizing our fraud landscape were ill-equipped to ingest real-time data and weren’t agile enough for the pace of change. Our classic BI dashboards would too quickly become obsolete as fraud tactics shifted.

Slow Queries

In order to have a holistic view of our ecosystem and successfully monitor for fraud or other anomalies, we needed to be able to quickly query and visualize very large datasets. Our existing analytics stack had served us well for historical reporting and batch jobs but wasn’t designed for investigative analytics, where the issues are time-critical and response times are key to minimizing losses.

Technical Barriers

Any options within our existing infrastructure for accessing real-time data required learning to use a custom query language for the platform. The technical barriers meant analysts would spend their time fighting with syntax and optimization, rather than doing what they do best: identifying patterns and driving value with our data.

As we entered 2020, we knew our ecosystem and event architecture had reached a level of maturity that would allow us to resolve these pain points, not only for fraud but for use cases across the company.

As we entered 2020, we knew our ecosystem and event architecture had reached a level of maturity that would allow us to resolve these pain points, not only for fraud but for use cases across the company.

Before selecting Imply, Ibotta evaluated several alternatives spanning categories such as log management, cloud monitoring, distributed search, and cloud BI. As with most things in life, there was no silver bullet – each one included the capability to access our event data in real-time, albeit through very different implementations with both assets and drawbacks.

After careful consideration, we found Imply to be clearly the most robust solution out of all of the platforms we were considering, that would allow us to meet three overarching business goals: supporting rapid incident response, building trust with our Savers and partners through proactive fraud prevention, and enabling more of our team to easily make use of our data.

Moreover, Imply met key specs around things like maintainability, workflows, cost, and security:

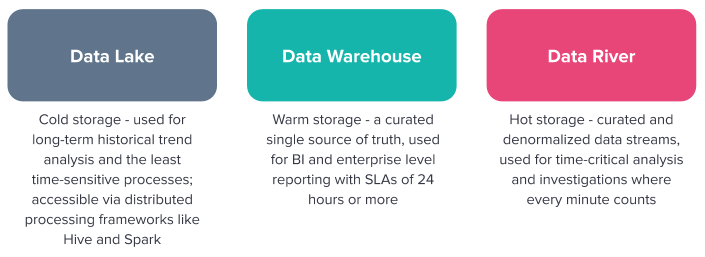

At Ibotta we separate our use cases into three storage layers: a data lake, data warehouse, and data river. Imply is now the foundation of our data river and serves as a key component in a broader analytical architecture at Ibotta, called Data Access in Real-Time (DART – anyone else a Stranger Things fan?). Various services within our system emit events, which we collect with an Event Observer implementation and pass through a series of Kinesis Streams and transformative AWS Lambda Functions. The results are then fanned out to Imply and other specialized consumers, which we use for custom anomaly detection and alerting workflows.

With the implementation of the data river, we have filled a major gap in our data ecosystem which up until now was preventing us from effectively conducting time-critical analytics. The data river runs in parallel with our existing pipelines to our data lake and warehousing solutions, but is completely decoupled, and designed to be extremely flexible. They are fed from the same source of truth but operate separately, with built-in resiliency to changes in one system or the other. This flexibility is particularly important for fraud data, as it allows us to limit sensitive data to the appropriate engineering teams as needed to comply with privacy rules.

The data river runs in parallel with our existing pipelines to our data

lake and warehousing solutions, but is completely decoupled.

With the DART architecture in place, the fraud team started to experience the benefits of Imply immediately. The previously mentioned roadblocks disintegrated. Now, for the first time, our analysts have immediate access to the same data our applications have been capitalizing on. They can see fraud as it’s happening.

In Imply, slow queries and syntax struggles have been replaced by Pivot’s Data Cubes offering slice and dice functionality with sub-second response times. Instead of obsolete reports and dispersed data, we now have a highly interactive real-time dashboard that incorporates both internal customer interaction events and data from each of our vendors. With this powerful tool, the team is armed with a holistic view of both fraud and our application ecosystem.

All of this is empowering our on-call team like never before, resulting in very tangible time and thus cost savings.

With each new technology we integrate into our system and workflows, we grow and mature as an engineering organization. They force us to rethink old assumptions and develop new patterns. Imply has been no different. From the completed implementation of our first project we have come away with many valuable pro-tips about ways to shift mindsets from traditional analytics to make the best use of a real-time system. But at the end of the day, it all really boils down to this: focus on the experience of your stakeholders.

It all really boils down to this:

focus on the experience of your stakeholders.

The whole point of a data river is to make the information within it available and actionable as fast as possible. This means that it should take very little effort for end users – who may or may not have the technical know-how to execute complex SQL queries or build reports from scratch – to digest the data in front of them.

As system designers, then, it’s our responsibility to remove complexity upfront. We need to narrow our focus to their task at hand when modeling how to format and aggregate incoming data, so that it’s highly optimized in terms of speed, completeness, and relevance to what the end user is trying to accomplish. In other words: congratulations! You are now a UX designer (don’t panic if you live in the backend – it’s fun, we promise).

Now, this is not to say that reusability and consistency with the rest of the organization isn’t important. It is, for all kinds of reasons, not least of which is the cost of resources needed to store, process, and analyze high-volume datasets. But the nature of this particular flavor of analytics – especially in high-risk and time-sensitive domains like fraud – means that in this case, balancing ease-of-use with cost optimization and other organizational practices becomes mission-critical.

So, to design a data river which minimizes your stakeholders’ cognitive load, we suggest asking questions like these during the data modeling process:

Data lakes and warehouses exist to provide broad accessibility to the data ecosystem for a wide set of use cases, usually at the cost of speed and technical barriers to entry. But by taking these questions under consideration when we’re building a data river, we can fine-tune the tool to work extremely well for specific use cases where the goal is enabling rapid response.

While fraud prevention was the impetus for investing in Imply, the benefits extend far beyond it. At Ibotta, one of our Core Values is that “a good idea can come from anywhere.” We firmly believe that our most valuable assets are the creativity and vision of our team. Our partnership with Imply supports this value by giving more of our people more access to our data, empowering them to innovate, iterate, and further our mission to “Make every purchase rewarding.”

Due to the highly technical nature of real-time data systems, many companies rely on a small set of skilled and specialized technicians to work with data and provide answers to the business. But that small set of specialists does not scale to a large user base, especially when organizations are trying to push decision-making down to front-line business users who need to react quickly as events are unfolding.

Instead, Imply is helping us lower the technical barriers to entry and enable need-to-know employees without an engineering or data science background to add value to the data in a way that makes sense to them, and is unique to their area of expertise. Democratizing our data has made it available to a larger community of team members to leverage for improving the business.

This empowerment is allowing us to expand our real-time use cases beyond fraud detection into several business domains, including:

With that said, we are already immensely pleased with our experience and results. We look forward to opening up the system to a broader user base and watching the inevitable transformation as teams across the company gain access to real-time data.

Build yourself a data river and combat fraud with Imply.

Streamlining Time Series Analysis with Imply Polaris

We are excited to share the latest enhancements in Imply Polaris, introducing time series analysis to revolutionize your analytics capabilities across vast amounts of data in real time.

Learn MoreUsing Upserts in Imply Polaris

Transform your data management with upserts in Imply Polaris! Ensure data consistency and supercharge efficiency by seamlessly combining insert and update operations into one powerful action. Discover how Polaris’s...

Learn MoreMake Imply Polaris the New Home for your Rockset Data

Rockset is deprecating its services—so where should you go? Try Imply Polaris, the database built for speed, scale, and streaming data.

Learn More